A Senate Republican wants to codify President Donald Trump’s desire to cap credit card interest rates, but it’s an idea that’s already been met with resistance among top Republicans.

Sen. Roger Marshall, R-Kan., plans to introduce legislation that would make good on Trump’s push to cap credit card interest rates at 10% for one year. However, Republican leadership in both chambers has already pushed back against the idea, arguing that it could lead to credit scarcity.

Marshall’s bill, the Consumer Affordability Protection Act, would limit the amount that credit card companies could charge for one year, capping the ceiling at Trump’s desired rate of 10%.

That cap would only apply to banks and financial institutions with over $100 billion in assets, with the idea being that smaller community banks and most credit unions would not be affected.

Marshall said in a statement to Fox News Digital that the legislation was about ‘giving families breathing room, restoring fairness in the marketplace, and making sure the American Dream is still within reach for everyone who works hard and plays by the rules.’

‘Credit cards were meant to be a tool — not a trap,’ Marshall said. ‘Right now, millions of hard-working Americans are getting crushed by outrageous interest rates that make it nearly impossible to pay down debt and get ahead.’

The bill follows Trump’s demand that Americans no longer be ‘‘ripped off’ by credit card companies that are charging interest rates of 20 to 30%, and even more, which festered unimpeded during the Sleepy Joe Biden Administration.’

He set a target date for the cap of Jan. 20, the one-year anniversary of his inauguration to his second term in office.

‘AFFORDABILITY! Effective January 20, 2026, I, as President of the United States, am calling for a one year cap on Credit Card Interest Rates of 10%,’ Trump said on Truth Social.

Marshall’s push isn’t his first foray into the world of credit — he and Senate Minority Whip Dick Durbin, D-Ill., have a long-simmering bill that would boost competition among credit card payment networks. Trump endorsed that legislation earlier this week, and the bipartisan duo reintroduced it in the Senate shortly after.

Durbin and Sen. Peter Welch, D-Vt., are co-sponsors of Marshall’s latest bill. Trump and Marshall also have an unlikely ally in Sen. Elizabeth Warren, D-Mass. The progressive lawmaker spoke with the president earlier this week about affordability, and both found middle ground on their desire to cap credit card interest rates. But she was wary that any real action, either from the White House or the GOP-controlled Congress, would come to fruition.

‘I supported it for years,’ Warren said. ‘And when he first floated the idea over a year ago, I said, ‘I’m all in,’ and so far, Trump hasn’t done anything.’

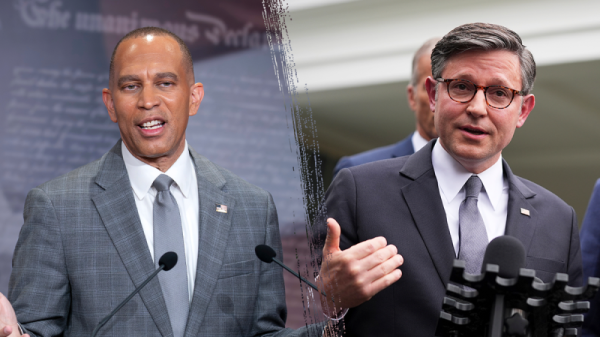

But despite Trump’s edict and the patchwork of bipartisan support, the top Republicans in Congress aren’t completely sold on the idea.

Senate Majority Leader John Thune, R-S.D., warned that capping credit card interest rates could ‘probably deprive an awful lot of people of access to credit around the country.’

‘Credit cards will probably become debit cards,’ Thune said. ‘So, yeah, I mean, that’s not something I’m out there advocating for.’

And House Speaker Mike Johnson, R-La., warned of ‘unintended consequences’ of such a change.

‘One of the things that the president probably had not thought through is the negative secondary effect: they would just stop lending money, and maybe they cap what people are able to borrow at a very low amount,’ Johnson said.