Earnings season continues with names like Home Depot, Palo Alto Networks, and BJ’s Wholesale flashing signals that investors shouldn’t ignore. Whether you’re following home improvement trends, cybersecurity growth, or retail resilience, these stocks offer insight into where the stock market could be headed next.

Earnings season continues with names like Home Depot, Palo Alto Networks, and BJ’s Wholesale flashing signals that investors shouldn’t ignore. Whether you’re following home improvement trends, cybersecurity growth, or retail resilience, these stocks offer insight into where the stock market could be headed next.

Let’s break down the charts, decode the earnings, and explore the setups that could shape your next move.

DIY Boom Fizzling: What Home Depot’s Earnings Might Tell Us

Home Depot, Inc. (HD) reports earnings on Tuesday, and its results will give a peek at how the DIY home retail investor is changing their spending habits. HD’s stock price has struggled and is down about 2.5% year-to-date, but well off its lows. Like most stocks reporting earnings this quarter, investors will listen for any revisions to HD’s guidance, especially considering ongoing economic challenges such as high interest rates and their impact on consumer spending.

Let’s look at the daily chart of HD.

FIGURE 1. DAILY CHART OF HOME DEPOT, INC. STOCK PRICE. The $377 area and 200-day moving average act as the middle road for a potential setup.Chart source: StockCharts.com. For educational purposes.

The chart of HD stock displayed a head-and-shoulders top last quarter, which we warned about. Sadly, that pattern broke to the downside and hit its target some $50 lower. Since bottoming, shares have retreated to where they were before their last report.

The set-up is a coin flip, with the $377 area and 200-day simple moving average (SMA) acting as the middle road. Stock prices are known to gap and trend for roughly two weeks in the gap’s direction before reversing direction.

If HD’s stock price dips, there are clear support and potential entry points. Look for the rising 50-day SMA to hold at around the $360 level. A dip and hold here would be good for the longer-term turnaround story and the bullish case. If there’s a break, wait for a deeper drop to enter HD. A gap above the 200-day SMA should lead to near-term smooth sailing and enable a trader to use the average as a great stop loss guide.

Palo Alto Networks (PANW): Can It Keep Climbing?

It’s one of the biggest names in cybersecurity, and it’s on the verge of getting back to its all-time highs.

Fundamentally, Palo Alto Networks’ annual recurring revenue (ARR) continues to be the significant growth driver. In Q1, ARR grew 40% year-over-year to $4.5 billion. For Q2 2025, the company projected ARR between $4.70 billion and $4.75 billion. Investors will be keen to see if the company meets or exceeds this guidance.

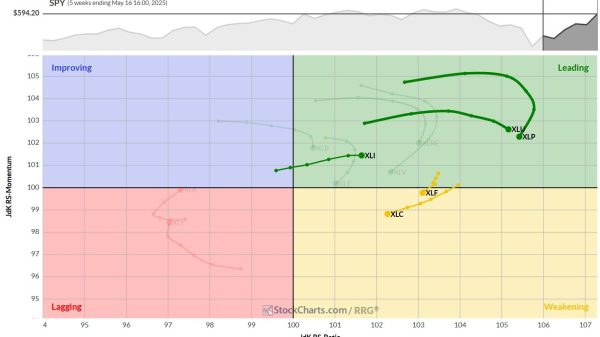

Technically, we wanted to look at this chart on a longer time frame. The five-year weekly chart of PANW below shows the trend is stalling under a double top at the $205 level. There are some good signs that it may be able to get back on track and push to new highs.

FIGURE 2. WEEKLY CHART OF PALO ALTO NETWORKS STOCK PRICE. Monitor the rising 50-week SMA. Will it hold that level after earnings? The MACD is displaying a bullish crossover, which signals a favorable risk/reward setup.Chart source: StockCharts.com. For educational purposes.

The key level to watch for the bulls is the rising 50-week (blue line) SMA. Shares had consistently trended above this level since initially surpassing it in early 2023. Price action briefly broke below that average, but recaptured it two weeks ago. Now it must hold that level, so watch $178.50 for support on any weakness.

The technical indicator that caught my eye was the moving average convergence/divergence (MACD), which just experienced a bullish crossover. This has a history of leading to great risk/reward setups in a stock. The chart highlights the current crossover and the last two notable ones in green to demonstrate the indicator’s past performance.

Any upside movement should take PANW’s stock price back to the $205 level and a re-test of all-time highs.

BJ’s Wholesale (BJ): Quietly Outperforming

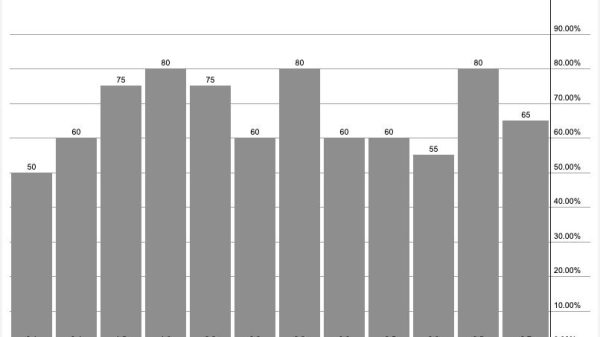

BJ’s has quietly enjoyed a strong 2025, despite tariff talk and negative consumer sentiment. Shares of BJ are up 29% year-to-date and over 44% over the last 52 weeks. While its $14 billion market cap pales in comparison to the $450 billion size of its biggest wholesale competitor in Costco (COST), BJ continues to exceed expectations and thrive.

BJ’s stock price has rallied after four of the last five earnings reports, with an average gain of 8%, including a 12% rally last quarter. Coming into the results, the stock price is starting to rally back towards all-time highs. Maybe this will be the catalyst to break out even higher.

Technically, there is much overhead resistance at the $120 level (see daily chart of BJ below). A break above there should lead to another $10–$15 on the upside.

FIGURE 3. DAILY CHART OF BJ STOCK. Note the overhead resistance at around the $120 level. On the downside, there’s support at $108 and the rising 100-day SMA.Chart source: StockCharts.com. For educational purposes only.

Weakness has given investors opportunities as well. There is clear support at the $108 level and the rising 100-day SMA (in green). The long-term trend has been strong and, barring a major change in the fiscal direction of BJ’s, the trends should continue to be your friend and give solid risk/reward entry points.

Final Thoughts

Charts aren’t just squiggly lines. They’re tools to help you make smarter decisions with your hard-earned money.

Whether you’re eyeing a potential rebound in Home Depot, the strength of cybersecurity, or a quiet winner like BJ’s, remember: technical patterns can give you an edge, but so can patience and perspective.